The year 2024 was marked by rising trade tensions, record levels of tariffs, and a fierce struggle over the future of the global steel market. While demand remained weak, competition heated up, fueled by a surge in low-cost exports from China and a wave of protective trade policies worldwide.

China’s Steel Export Boom

One of the biggest stories of 2024 was China’s massive increase in steel exports.

- China exported over 108 million metric tons of steel, a 14% jump from 2023.

- Exports more than doubled since 2020, pushing volumes to levels last seen in 2015.

- Domestic demand in China weakened sharply due to a slowing real estate sector, leaving producers with surplus steel to sell abroad.

This excess supply flooded markets in Southeast Asia, the Middle East, Latin America, and beyond. As Chinese producers slashed prices, they gained market share at the expense of local producers in other countries.

Global Trade Under Pressure

This surge in Chinese steel exports triggered a global reaction.

- Many countries saw a sharp increase in steel imports from China, threatening local industries.

- Prices for finished steel products fell worldwide due to oversupply.

- Domestic producers in places like Europe, Japan, and Korea struggled to compete, raising fears about the sustainability of their industries.

The aggressive pricing strategy—selling at lower costs to clear excess capacity—forced many steelmakers to cut margins or risk losing customers.

Explosion of Trade Defenses

Governments responded with a wave of trade defense measures aimed at protecting their industries.

- A record 67 new anti-dumping investigations were launched between January and September 2024.

- Countries also introduced countervailing duties, safeguard tariffs, and quotas to limit cheap imports.

- Many of these measures specifically targeted Chinese steel, but other exporters were affected too.

The United States and Canada imposed new or expanded tariffs on Chinese steel, citing unfair trade practices. Mexico and Brazil also raised tariffs or introduced quotas to defend local production.

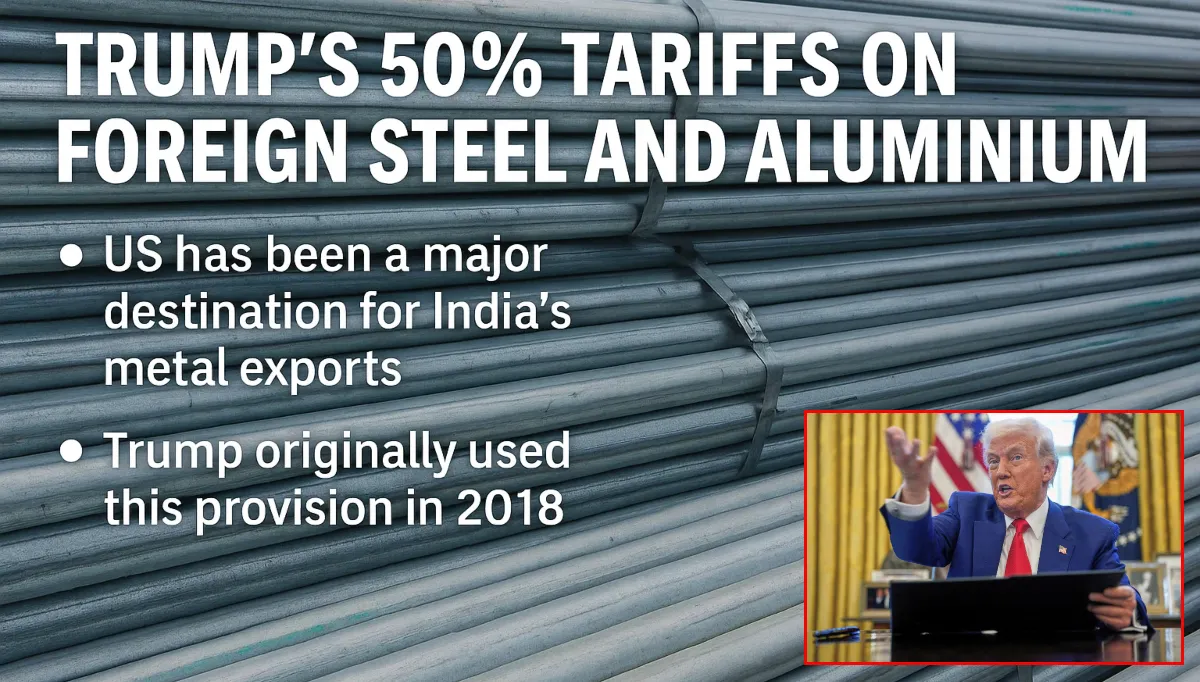

U.S. Tariff Activity

In the U.S., two main tools shaped policy:

- Section 232: Applied on national security grounds, the U.S. continued tariffs on steel imports, including new measures targeting imports from Mexico that were not fully produced in North America to close loopholes.

- Section 301: The U.S. reviewed and expanded tariffs on Chinese-origin steel and steel-intensive goods, citing unfair trade practices. Tariff rates on some items increased to 25%.

These moves underscored Washington’s determination to protect its steel industry while confronting China over alleged unfair subsidies and dumping.

Shifting Global Trade Patterns

The flood of cheap steel exports did more than just threaten individual countries—it reshaped trade flows:

- ASEAN countries (Southeast Asia) became the largest importers of steel, with imports rising nearly 6% in the first half of 2024.

- The European Union saw a 10% increase in imports, despite ongoing demand challenges in its construction sector.

- U.S. imports climbed 7%, reflecting both strong import demand and continued dependence on foreign sources.

Even as prices dropped, countries found it difficult to replace certain types of steel that weren’t readily available from domestic mills, forcing them to keep importing despite tariffs.

Falling Prices, Rising Risks

Prices for many steel products fell sharply in 2024:

- Despite export volumes rising, the value of Chinese steel exports actually declined.

- This divergence—more tons, lower prices—shows how producers were willing to accept thinner margins to maintain sales.

- The global glut put severe pressure on steelmakers’ profits outside China, risking closures and layoffs.

Such pricing practices also reignited debates about the fairness of China’s trade practices, with accusations of government support and non-market behavior.

Outlook for 2025 and Beyond

Trade tensions in the steel sector are unlikely to ease soon.

- Excess capacity in China remains a structural problem, with domestic demand unlikely to recover quickly.

- Countries are expected to continue or even expand trade defense measures to protect local producers.

- Supply chains may adjust, but completely replacing imports of certain specialized steels is difficult and costly.

- Geopolitical tensions, including conflicts and shipping disruptions, could further complicate trade flows and pricing.

Governments will face tough choices balancing the desire to shield local industries with the need to control inflation and maintain competitive manufacturing sectors.

The Bigger Picture

Steel is not just another commodity—it is a foundation for construction, transportation, energy, and defense.

The year 2024 showed how excess supply, aggressive pricing, and protectionist policies can reshape global commerce. While consumers may see some lower prices in the short term, the long-term risks include weakened local industries, job losses, and more volatile trade relationships.

As policymakers look to 2025, they will need to navigate these challenges carefully, seeking ways to ensure fair competition, preserve critical industries, and maintain a stable global trading system.