The U.S. steel industry is witnessing a surprising trend: even with high tariffs in place, steel import volumes are rising. This development sheds light on the complex nature of global trade, supply chains, and tariff policy.

Background: Why the Tariffs Exist

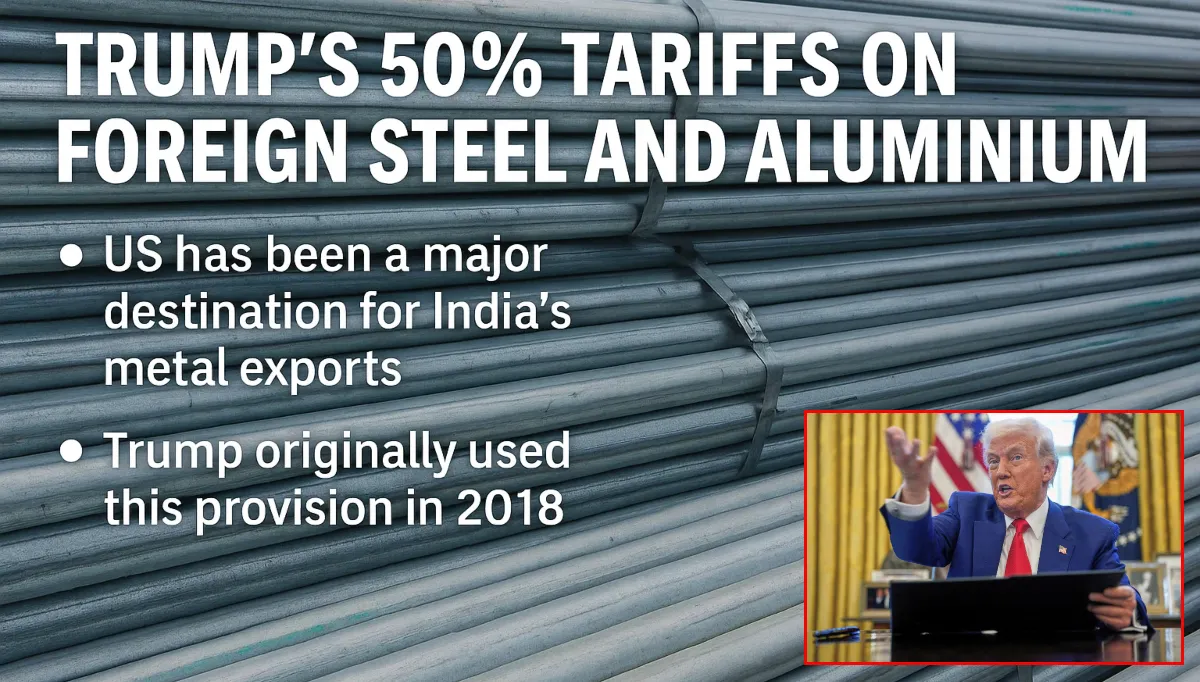

In 2018, the United States imposed Section 232 tariffs of 25% on steel and 10% on aluminum imports, citing national security concerns.

The government argued that a strong domestic steel industry is essential for defense needs and critical infrastructure. These tariffs were meant to:

- Protect American steel producers from foreign competition

- Encourage domestic investment and production

- Reduce reliance on imports in times of crisis

However, the policy also drew criticism. Many trade partners argued it was protectionism disguised as national security. The World Trade Organization (WTO) later ruled these tariffs violated trade rules, but the U.S. refused to remove them, insisting that national security decisions are sovereign.

Recent Changes: Tariff Increases

In June 2025, the U.S. government announced a dramatic escalation of these tariffs, doubling them to 50% on certain steel and aluminum imports. This move was intended to:

- Counter a surge in low-priced imports

- Support struggling domestic mills

- Address new geopolitical tensions

The announcement caused shock in the global market, leading to sudden price volatility and uncertainty for buyers.

Why Are Steel Imports Rising Anyway?

Despite these high tariffs, data show import volumes have recently rebounded. Several factors explain this surprising trend:

1. Front-Loading Before Tariff Hikes

Importers anticipated that tariffs would increase even further. Many buyers rushed to place orders before the higher rates took effect.

This “front-loading” led to a surge in shipments in early 2025, with steel arriving at U.S. ports even after tariffs officially increased.

2. Timing and Contracts

Steel is often bought via long-term contracts and shipped over weeks or months. Orders made before the tariff hike can still enter under older, lower rates or with negotiated deals.

This means even after tariffs rose to 50%, the pipeline remained full with previously ordered steel.

3. Global Oversupply and Pricing Pressure

The global steel market has experienced periods of oversupply. Foreign producers, facing weak demand at home, often discount prices aggressively—even when tariffs are factored in.

Some buyers find imported steel remains cost-competitive after taxes, especially for certain specialty grades or in regions where U.S. production is limited.

Market Impact and Price Trends

Steel market dynamics have been highly volatile:

- Futures contracts for U.S. steel surged nearly 14% in early June, as traders priced in the shock of the new tariffs.

- Spot prices remained steadier, reflecting uncertainty about real demand.

- Some buyers held off on new purchases at ports, wary of paying higher costs immediately after the tariff increase.

Overall, prices remain unpredictable, complicating planning for manufacturers, builders, and infrastructure projects.

Industries Feeling the Impact

Tariffs on steel have ripple effects throughout the economy.

- Oil and gas companies are particularly affected. Steel is critical for pipelines, rigs, and drilling equipment. A recent survey suggested about 27% of firms plan to drill fewer wells due to higher steel costs.

- Construction and manufacturing companies face challenges sourcing affordable steel, which can slow projects or raise costs for consumers.

- Clean energy projects—including wind turbines and solar infrastructure—rely on steel components that are harder to source cheaply when tariffs rise.

Trade Policy Uncertainty

Businesses face ongoing uncertainty around U.S. trade policy:

- The WTO has ruled against the U.S. tariffs, but the dispute resolution system is partially paralyzed. Appeals are effectively on hold.

- The U.S. government maintains that national security justifies these tariffs, with no plans to remove them.

- Other countries have threatened or implemented retaliatory tariffs on American goods, increasing trade tensions.

This unpredictable environment makes it harder for manufacturers to plan their supply chains and budgets.

The Bigger Picture: Can Tariffs Succeed?

Supporters of the tariffs argue they are necessary to:

- Protect American jobs

- Maintain strategic production capacity

- Counter unfair trade practices, such as dumping by foreign producers

Critics warn that tariffs:

- Raise costs for U.S. businesses and consumers

- Disrupt supply chains without guaranteeing investment in domestic capacity

- Trigger retaliatory measures from trading partners

The rebound in imports despite higher tariffs suggests the policy may have limits. Global supply chains are hard to control, and businesses will continue to seek cost-effective options even with steep taxes.

Looking Ahead

The future of U.S. steel imports will depend on several factors:

- Whether demand stays strong for construction, manufacturing, and energy projects

- How long buyers can rely on pre-tariff contracts

- Whether the government adjusts or enforces tariffs further

- Potential negotiations or trade deals with key partners

For now, the rebound in steel imports underscores that global trade is resilient and complex—even when high tariffs try to block the flow.

Author Thought

Steel is the backbone of modern economies. Tariffs are a powerful but blunt tool to shape markets and protect industries.

The recent rise in U.S. steel imports, despite record-high tariffs, shows that market forces, timing, and global supply chains continue to play a major role.

Businesses, policymakers, and consumers will all be watching closely to see whether these measures truly strengthen American industry or simply raise costs and uncertainty without delivering on their promises.