The State Of Retirement Savings.The preparation of Americans to retire in 2025 represents a mixed picture, with outstanding challenges and discrepancies across generations. Americans believe that retirement should be a time of enjoyment and relaxation, not financial stress or issues.

But the question is, are Americans truly prepared? With rising living costs, longer lifespans, and unpredictable market prices, the inflation rate and the savings for retirement are becoming more challenging than before.

According to a new survey report, the study of approximately 1100 U.S adults confirmed how they observe retirement. When asked about the feelings of retirement, some Americans (75%) manifest positive responses of feeling happiness (47%) and appreciation (35%). From the survey, almost 90% don’t anguish after retirement after they spend so many golden years in a job. 35% said it’s a preferable choice than imagination.

In this guide, we’ll discuss how much the average American has saved for retirement, Smart strategies to catch up if you’re behind, and how different generations are preparing to secure a comfortable retirement

The Reality of Retirement Savings in Past Years

The question is, how much do Americans have saved? Below is the data on retirement savings across age groups.

| Age Group | Average Retirement Savings | Median Retirement Savings |

| 20-29 | $42,000 | $15,000 |

| 30-39 | $112,000 | $45,000 |

| 40-49 | $255,000 | $90,000 |

| 50-59 | $408,000 | $135,000 |

| 60+ | $460,000 | $160,000 |

Notes:

- Median retirement savings are much lower than averages because a few wealthy individuals tilt the numbers.

- Less than $200,000 is saved by many people in their 50s and 60s as far below what’s needed for a secure retirement.

Why Are So Many Americans Left Behind?

Several factors that contribute to the retirement savings crisis, like loss of job, sudden exchange of medical bills, natural disasters, unplanned trip, coronavirus, and many more, are causes to force retirement savings to a minimum. Early withdrawal of money impacts the savings for the future.

A. Stagnant Wages & Rising Costs

- High expenses in Housing, healthcare, and education have surged to a peak, leaving less for savings.

- Payment or wages of many workers are not kept up to time.

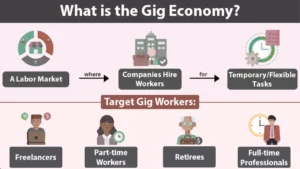

B. Lack of Employer Retirement Plans

- There are only 58% of workers who have access to a 401(k) or pension.

- Retirement benefits are passed out by Gig workers and part-time employees

C. Debt Burdens

- Loans such as Student loans, credit cards, and mortgages are major drawbacks that induce retirement contributions.

- Debts of many volunteers or retirees are still pending after retirement, which slows down the monthly cash flow

D. Procrastination & Financial Illiteracy

- Not paying interest at the right time will result in compound interest, and “I’ll save later “works best over decades.

- Many people don’t know the income and expenditure process of investment.

How Much Should You Really Have Saved?

To make a difference in investment return and expenditure, a common rule known as the “10x Rule” (the only difference between success and failure) is applied.

In this rule, you must first make an investment return equal to at least 10X the cost of such product or service.

- By age 67, you should have the 10x rule implemented in your annual salary.

- Example: If you earn $60,000/year, aim for $600,000 by retirement.

But this varies based on:

- Your lifestyle, whether you want to travel or live prudently?

- The need for Healthcare, as Medicare doesn’t cover everything

- Social Security benefits.

How Different Generations Are Preparing

Retirement wishes vary with every stage of life. Depending on the generation gap, like Gen Z, Gen X, they invest money in travelling. While millennials prioritize money on family and friends, and the generation after invest two decades of time and money in resting.

| As per a survey in 2025 | ||

| Generation | Top Retirement Challenges | Best Strategies |

| Gen Z (18-27) | Student debt, low early-career wages | Start small (even $50/month in a Roth IRA) |

| Millennials (28-43) | High housing costs, delayed savings | Max out 401(k) matches, side hustles |

| Gen X (44-59) | Sandwich generation (kids + aging parents) | Aggressive catch-up contributions |

| Boomers (60+) | Healthcare costs, market volatility | Downsizing, part-time work, annuities |

How to Catch Up If You’re Behind

To catch up, the citizens should boost savings methods, like 50%,30% and 20%, which means 50% for needs, 30% for wants, and 20% for savings and debt repayment.

A. Boost Savings Immediately

- Follow the 50/30/20 % rule: 20% of income toward savings.

- Automate contributions, out of sight, out of mind.

B. Take Advantage of Retirement Accounts

In America, there are different retirement plans for health, traditional plan, percentage of health, savings, and investment plans to save money after retirement.

| Account Type | 2024 Contribution Limit | Best matches for |

| 401(k) | $23,000 ($30,500 if 50+) | Employer matches, high earners |

| IRA (Traditional/Roth) | $7,000 ($8,000 if 50+) | Tax-free growth (Roth) or deductions (Traditional) |

| HSA (Health Savings Account) | $4,150 (individual) | Triple tax benefits (if used for medical costs in retirement) |

C. Reduce Debt Before Retiring

- High interest rates are paid at first, like a credit card or a personal loan.

- Decrease in mortgage/rent costs.

D. Work Longer after 60 years

- If you take retirement money after 70, you may have additional benefits. Means benefits of 8% profit per year from your retirement bucks.

- Part-time work before retirement can have a special effect on saving.

Tips for a Stress-Free Retirement

- Diversify investments, don’t rely only on stocks or savings accounts

- Plan for healthcare costs like Medicare & supplemental insurance

- Test your retirement budget, try living on it for 6 months before retiring.

- Consult a financial advisor to invest your money systematically in the right direction.

- Invest in the market at a younger age.

Conclusion

Even if you are left behind, take small steps to make a big difference today. Starting from today, whether you save $100 per month by cutting unnecessary expenses or investing in the right direction, you can invest in mutual funds, SIP, and FD. Retirement shouldn’t be a venture. With smart planning, you can enjoy your golden years without financial fear.

| Home Page | https://aiis.org/ |

FAQs for The State Of Retirement Savings

What if I have nothing saved at 50?

Make contributions of $7,500 extra in 401(k), reduce the spending, and work a few extra years.

How much Social Security will I get?

Check your estimated benefits at SSA.gov. The average monthly payout in 2024 was $1,907

Should I pay off my mortgage before retiring?

It totally depends on whether your mortgage rate is lower than 4%, or paying extra cash will be a better option.

Can I retire with $400,000?

Possibly, if you have low expenses and additional income (Social Security, part-time work)