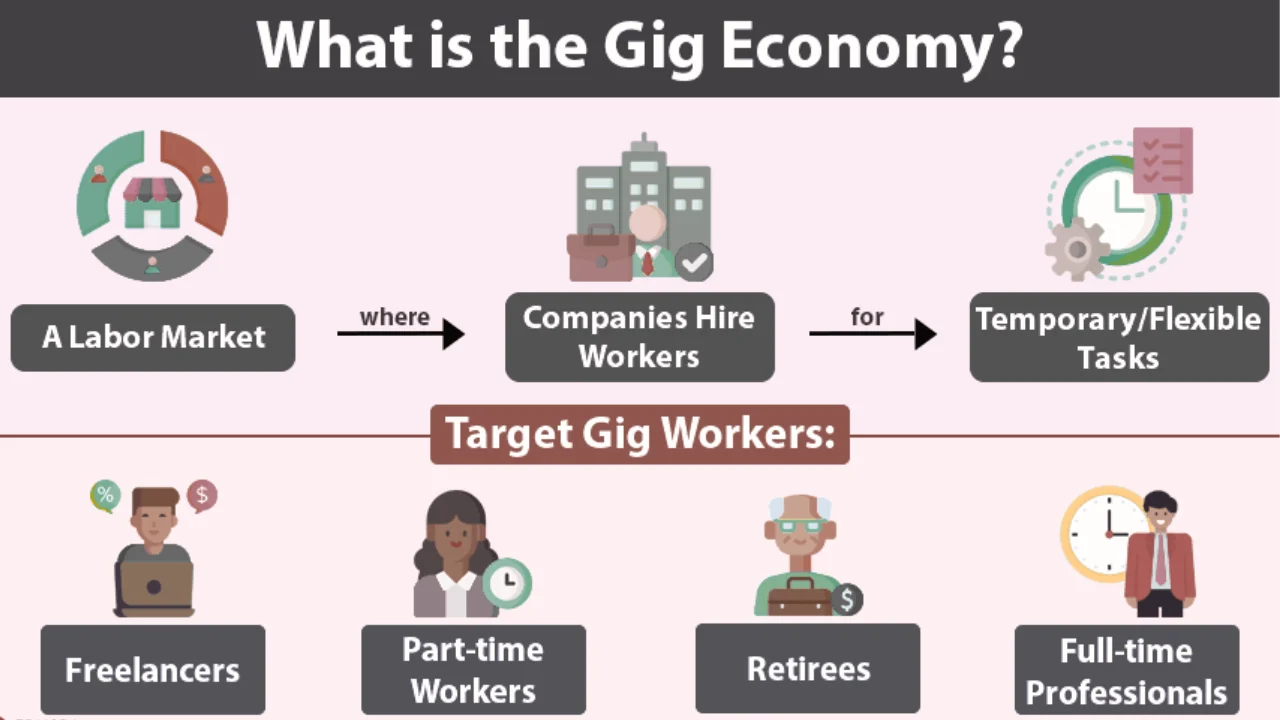

Over 1.6 billion people, accounting for nearly 12% of the total global population, are employed in the labor market. The way The Gig Economy in 2025 is working progressively fast. In 2025, the gig economy in the U.S will distinguish the new labor rules with a remarkable workforce by taking part in freelance or online jobs.

By 2025, new labor regulations will modify how independent contractors, freelancers, and gig workers operate. For example, whether you drive for Uber, freelance on Upwork, or rent out property on Airbnb, these changes could enhance your earnings, benefits, and legal protections.

New regulations could reshape how much you earn, what benefits you receive, and how independently you can work.

In this article, we’ll walk through some of the beneficial and quality gigs.

- The new laws that will shake up the gig economy in 2025

- What “employee vs contractor” changes mean for you

- New benefits you might qualify for

- How to prepare for these changes

Labor Rules Of The Gig Economy In 2025 : What’s Changing?

The administration of the Labor Department has revoked the Biden-era rule. Focused on reclassifying gig workers as associates or jobholders, which makes it simpler for companies to organize workers as self-sufficient freelancers. The government is creating new rules to protect the Gig Economy for workers. Here’s the breakdown:

| 2025 Gig Economy Changes At A Glance | ||

| Change | What It Means | Who It Affects Most |

| Stricter worker classification | More people will qualify as employees, not contractors | Rideshare drivers, delivery people |

| Minimum pay guarantees | Apps must pay an hourly minimum during active work | Drivers waiting between rides |

| Possible healthcare benefits | Platforms may need to help pay for insurance | Full-time gig workers |

| Paid sick days | Earn 1 hour of sick pay per 30 hours worked | California, New York workers first |

| Easier to unionize | Workers can team up to negotiate better pay | Food delivery, rideshare drivers |

Note :

There is a big breakdown. Starting January 2025, the organization of Labor’s new rule will make it harder for companies to call workers “independent contractors/freelancers.” Many gig workers will likely be recategorized as employees.

Employee vs. Independent Contractor: New Tests

The U.S. The Department of Labor (DOL) has recently introduced the guidelines for classified workers as freelancers or full-time job seekers in 2025. These changes can affect the payment, benefits, or rights in the workplace. 2025 brought the clear criteria

| Employee vs. Contractor Checklist (2025) | ||

| Factor | Employee | Independent Contractor |

| Profit/Loss Opportunity | Paid fixed wages, no financial risk | Can earn more/lose money per job |

| Investment | The company provides tools/vehicles | You supply your equipment |

| Permanency | Ongoing work relationship | Short-term/project-based |

| Control | Employer sets schedule/rules | You choose when/where to work |

| Skill Required | Routine tasks | Specialized skills needed |

| Integral to Business | Core to the company’s services | Ancillary service provider |

| Tools Provided | The employer supplies equipment | The worker uses their tools |

Note: If your gig looks more like a “job,” you can be classified as an employee.

For example :

- Under the new rule in 2025, if John drives for Lyft 45 hours/week using Lyft’s apps by the navigation system, he/she may be considered as employed.

- Maria does graphics design on Canva for 10 clients; she will be considered a contractor.

Benefits & Protections for Gig Workers

If you’re recategorized as an employee, you could benefit in various ways from the US government.

- Minimum wage guarantees are often in slow periods

- An overtime payment will be given to 40+ hour workweeks

- In some states, Health insurance subsidies are given

- Workers’ compensation coverage for on-the-job injuries

- Unemployment benefits if you lose your job.

Note:

Employees might lose some flexibility, apps may assign shifts vs. letting you log in freely, set by job seekers, work for competing apps, and can skip undesirable jobs.

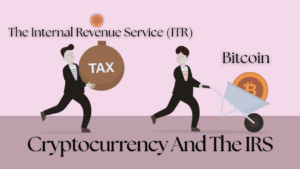

Tax Changes for Freelancers(The Gig Economy In 2025)

President of the U.S, Trump, has signed the new tax reforms for the betterment of freelancers on 4th July 2025. The new law is termed as “One Big Beautiful Bill Act”(BBB). This Law is implemented to understand the criteria and prepare for tax to be paid in the year 2025 and past over.

- As per the new rule, all gig earnings must be reported to the 1099-K Threshold Drops to $600.(tax year 2025 and beyond)

- Quarterly Estimated Taxes are still required for contractors

- Home office, mileage, and device write-offs expand Deductions

- Get a W-2 instead of a 1099

Tip: Use apps like Quick Books and Self-Employed to track deductible expenses and start to save 25 to 30% of your whole income.

How Gig Platforms Are Responding

Gig companies aren’t happy about paying more. Below is the table that they are using.

| Gig Platform 2025 | ||

|---|---|---|

| Company | Their 2025 Plan | What It Means For You |

| Uber/Lyft | Creating a “flexible employee” category | Some benefits, but fewer than full-time employees |

| DoorDash | Testing the “benefits points” system | Earn healthcare $ by completing deliveries |

| TaskRabbit | Cutting workers who exceed 15 hrs/week | Avoids employee classification |

Note:

Concern of workers: Will platforms cut jobs to balance costs?

6 Things Gig Workers Should Do Now

Gig workers should track the hours they work and can connect with other workers to save money. Below are the 6 points that gig workers should do.

- Track Your Hours and Use apps like Clockify to document work time

- Connect With Other Workers and join groups like the Gig Workers Collective.

- Plan to reduce Taxes and connect to a tax pro about your situation

- Watch notices if the Platforms have changed your status

- Capture pay rates and policies in case they change, take a screenshot, and save.

- Review Contracts: Watch for forced arbitration clauses

FAQs About the 2025 Gig Economy

Will I lose flexibility as an employee?

Possibly, some apps may assign shifts instead of an open login.

Do I qualify for unemployment benefits?

Only it is reclassified as an employee varies according to the state.

Q: Can I still deduct business expenses?

Yes, if you remain a contractor. Employees lose most deductions.

How will this affect my earnings?

W-2 employees may see higher base pay but fewer tips.