The Debt Ceiling Debate Explained.Almost every year, the term “debt ceiling” makes headlines, sparking political conflict and economic unpredictability. But the question is, what exactly is it, and why should everyday Americans care?

In simple terms, the debt ceiling is the legal limit on how much the U.S. government can borrow to pay its bills. When the government strikes this limit formally, it can be explained that the U.S. debt ceiling is like a credit limit for the federal government; Congress must raise or drop it, or risk a potential government shutdown or even a default on national debt.

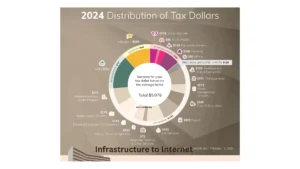

It limits how much money the U.S. can borrow to pay for things it’s already promised, like: Social Security & Medicare, Military salaries, and Interest on the national debt.

This debate isn’t just a political quarrel; it affects various jobs, Social Security, interest rates, and even savings. In this article, you will learn about the difference between the debt ceiling and why it exists. What Happens If the U.S. Hits the Debt Ceiling ? and many more.

What Is the Debt Ceiling & Why Does It Exist?

Money earned by taxes in the US government is less than the government spends, so to borrow money, Treasury bonds are issued. The debt ceiling is Congress’s way of controlling how much debt the country can take on.

Purpose Of The Debt Ceiling:

The debt ceiling came into force in 1917. The main purpose of the debt ceiling was to simplify the funds borrowed during World War 1, and be raised multiple of 100, increased at the request of both parties. Not a spending cap, it doesn’t limit new spending but allows borrowing to pay existing bills.

Why It’s Controversial:

Politicians often use the debt ceiling as a strength to push budget cuts or a change in policy, which leads to a last-minute deadlock.

5 Big Risks, Why The Debt Ceiling Matters

The debt ceiling is explained as the maximum limit the U.S. government can borrow to pay its existing commitments. Going over the debt limit without expanding could lead the U.S. Treasury to default on its debts, which in turn would hurt the economy badly.

There will be a drastic recession that will automatically take place, and losses of jobs, financial disruption, and lower market value will occur. Below are five major points of the default debt ceiling.

1. Government Default Risk

- Without a ceiling raised, the U.S. government could miss the payments of senior citizens, soldiers, and pensioners.

2. Imminent Economic Crisis

- Defaulting could break the markets, lift interest rates, and cause a recession.

3. Global Domino Effect

- The economy can be trembled worldwide as the U.S. dollar is the backbone of global finance.

4. Higher Borrowing Costs

- Higher interest on debt from the U.S. may increase future borrowing, and the U.S.S. could lose its AAA credit rating.

5. Your Wallet Impact

- There will be an overnight huge jump in mortgages, car loans, and credit card rates.

What Happens If the U.S. Hits the Debt Ceiling?

If Congress doesn’t raise the ceiling, the government can’t borrow more money. That means it may have delayed payments of Social Security, military salaries, or tax refunds.

- Sorting of certain bills by paying investors to avoid default

- If the debt payment is missed, the market can crash

- Delay in military salaries and tax refunds.

How Does the Debt Ceiling Affect the U.S.?

It’s not only the Washington problems, but the Americans are also affected.

A. Higher Interest Rates

- Increased cost rises if investors fear a U.S. default.

- Huge jumps in mortgages, car loans, and credit card rates.

B. Disorder Market & Retirement Accounts

- A 401K (employer retirement account) or an IRA (individual retirement account) will drop the stock market.

- Treasury bonds could lose value as it is perceived as the safest investment in the U.S.

C. Delayed Government Payments

- Delayed in the cheque of Social Security & Veterans’ Benefits

- Hold back on the payment of Federal Workers & Contractors

- Government contracts for Small Businesses may freeze.

D. Weaker Dollar & Inflation Risks

- A default could weaken the dollar, making imports (like gas & groceries) more expensive.

Why Do Politicians Fight Over the Debt Ceiling?

Both parties agree the ceiling must be raised to avoid disaster, but they often clash over how and when.

Republican Arguments:

- We should pair a debt limit increase with spending cuts to reduce deficits.

- Example: 2023’s Fiscal Responsibility Act, which capped some spending.

Democratic Arguments:

- The debt ceiling shouldn’t be political; defaulting would be economic suicide.

- Some want to abolish the ceiling entirely to avoid future crises.

Could the U.S. Default?

Technically, yes, but it’s unlikely because the outcome would be unfortunate:

- There will be a Global Financial Panic as the U.S. dollar is the world’s reserve currency.

- Investors would demand higher interest rates, which would lead to an increase in the Higher National Debt Costs.

- Chances of Recession: Businesses and consumers would pull back spending.

Debt Ceiling vs. Government Shutdown: What’s the Difference?

Many people confuse the two, but they’re not the same:

| Debt Ceiling Crisis | Government Shutdown |

| The U.S. can’t borrow more to pay bills. | Congress fails to approve a budget. |

| Risk: Default on debt (global crisis). | Risk: Services stop (parks close, workers furloughed). |

| Affects: Bond markets, interest rates, global economy. | Affects: Federal workers, and public services. |

Feasible Solutions & Why They’re Tricky

The following are the points of a feasible solution, such as raising or suspending the debt ceiling, and many more.

A. Raise or Suspend the Ceiling (Most Common Fix)

- Congress votes to increase the limit

- Problem: Politically putting a situation to the point of disaster without quite going over the edge by delaying action.

B. Mint a $1 Trillion Coin (Yes, Really)

- To create funds and deposit them at the Fed, the Treasury could mint a platinum coin.

- Problem: Seems to attract attention, not a long-term fix.

C. Abolish the Debt Ceiling

- Some economists argue it’s an outdated, dangerous tool.

- Problem: Requires Congress to give up leverage.

What Can Americans Do?

By following the steps, the U.S. government can help the federation.

- Americans can rely on verified sources for updated news. While they can’t control Congress

- Compensate to avoid economic risk by contacting your representatives.

- Prepare financially and avoid panic-selling investments if markets dip.

Conclusion

The debt ceiling debate isn’t just political theater; it’s about your wallet, your job, and your future. A default could trigger a recession, while even a near-miss can spike borrowing costs.

| Home Page | https://aiis.org/ |

The best outcome? Congress should stop using the debt ceiling as a bargaining chip and find a long-term solution because playing with economic fire helps no one.

FAQs for The Debt Ceiling Debate Explained

Who decides the debt ceiling?

Congress sets and raises it (though the Treasury can use “extraordinary measures” to buy time).

Does raising the ceiling increase spending?

No, it just lets the U.S. pay bills it already owes.

What happens if the ceiling isn’t raised?

The U.S. could miss payments, triggering a financial crisis.