Tariffs and Trade Wars.Trade pressure between the U.S. and China has moulded the global economy for nearly a decade. As we move through 2025, the relationship between China & the US is still complex, filled with tariffs, technology battles, and supply chains. Whether you’re a business owner, investor, or just someone keeping an eye on the economy, understanding these changes is crucial.

A trade war is an economic conflict where countries punish each other by increasing tariffs or trade restrictions. It often begins when a nation adopts extreme protectionist policies, leading the other side to retaliate with similar measures.

In this article, we will discuss the current tariff policies in 2025, how tech restrictions are reshaping industries, where businesses are moving production, what consumers should expect in pricing, and predictions for the future of the U.S.-China trade.

The State of U.S.-China Trade in 2025

The trade correlation between the US and China has always been a big deal, and pretty complex. As the world’s two biggest economies, they’ve been locked in a trade war, slapping taxes on each other’s goods and creating all kinds of economic burden.

But in June 2025, things took a turn when both countries agreed on a new trade deal. This agreement could transform global trade and change how countries do business with each other.

| Key Tariff Updates in 2025 | |||

| Category | U.S. Tariffs on China | China’s Response | Impact |

| Electronics | 25% on key components | Increased domestic production | Higher prices for phones, laptops |

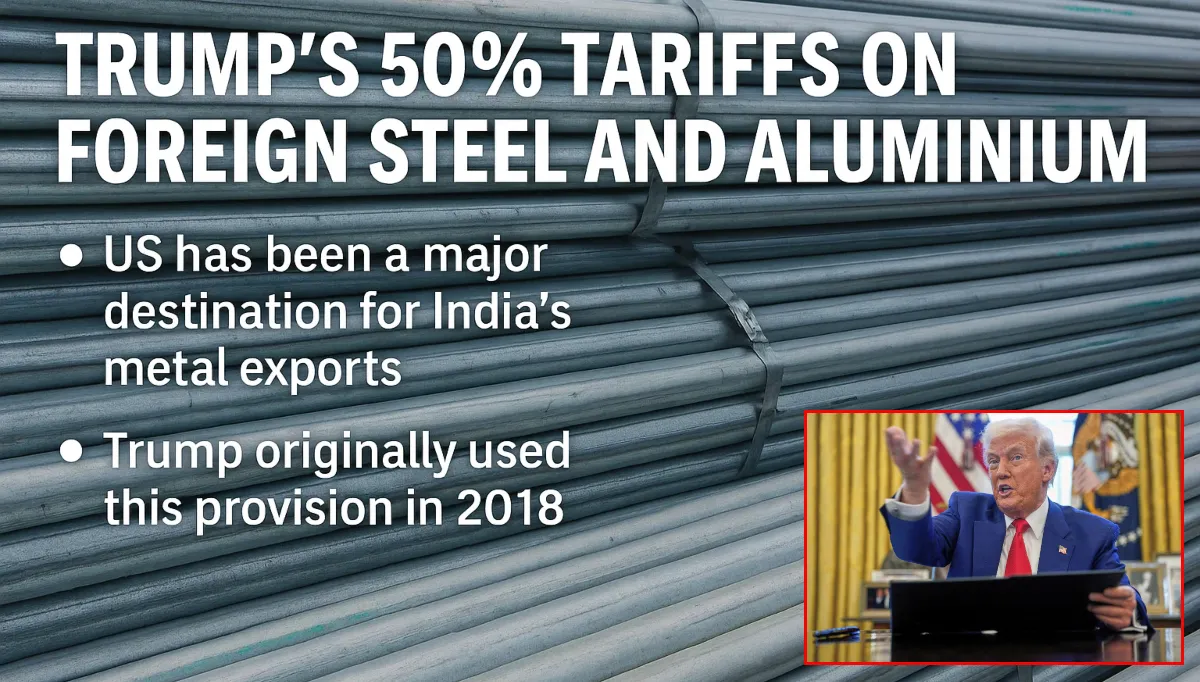

| Steel & Aluminum | 10-25% (varies) | Retaliatory tariffs on U.S. agricultural goods | Construction costs remain high |

| Automobiles | Reduced from 27.5% to 20% | Lowered tariffs on U.S. cars | More affordable electric vehicles (EVs) |

| Agricultural Goods | Some cuts (soybeans, pork) | Increased imports from the U.S. | Boost for American farmers. |

Note:

- Businesses still face higher costs for electronics and machinery.

- Consumers see mixed effects on some products, like EVs getting cheaper, while other gadgets remain costly.

- More soybeans and pork are sold by the U.S to China. Farmers in this field are benefiting the U.S.

1. Are Tariffs Still in Place?

Yes, but it’s complicated. The U.S.-China trade war started in 2018 with high import taxes on billions of dollars worth of goods. In 2025, some remain, while others have been modified or regulated to ease economic pressures.

| Tariff Reign (CHINA & US) | ||

|---|---|---|

| Category | Pre-May Truce | May–Aug 2025 Truce |

| Chinese goods imported to the US | Up to 145% | 30% |

| U.S. exports to China | Up to 125% | 10% |

| Steel & aluminum | 25%+ (Section 232) | Remains |

| Auto parts | 25% | Remains |

| Fentanyl-related items | 20% (Feb) | Remains |

2. Trade Flows & Economic Effects

US-China collective trade from 2024 to early 2025

1. Total Trade (Exports + Imports)

- 2024: $143.54 billion (down 2.8% from peak)

- Jan-Apr 2025: Dropped 12% to just $40 billion

- Supported 531,000 U.S. jobs in 2024

2. U.S. Imports from China

- 2024: $462.63 billion

- Jan-Apr 2025: Fell 7% to $128 billion (first decline in years)

3. Trade Deficit Shrinking

- Jan-Apr 2024: $95 billion

- Jan-Apr 2025: $88 billion (smaller gap)

Note: Trade between the U.S. and China is slowing down, with imports dropping and the trade deficit getting moderately smaller.

3. Broad & Household Impacts

1. Price stress: Inflation Hits Households

- +1.3% tariff is pushed in April alone.

- All 2025 tariffs combined added +2.3% to inflation.

- The average U.S. household lost $3,800 in purchasing power.

- Lower-income families or BPL have sacrificed higher crises, losing $1,700, leaving life for basics like food, gas, and rent.

2. Slowdown Growth: Economy Tariffs Weigh

- by 0.5 percentage points, GDP growth is shut down in April’s tariffs

- All 2025 tariffs together slowed growth by 0.9 percentage points.

- In the long term, the U.S. economy will be damaged as of now 0.6% ($160 billion per year) due to trade restrictions.

3. Uneven State-by-State Impact

- Farm & service-heavy states have borne more from lost exports and higher costs, e.g., Iowa, Nebraska.

Note:

The main aim of tariffs is to protect U.S. industries. As the U.S raised the price of everyday goods, which automatically slowed the economic growth, it affected farmers and low-income families & created factory jobs with long-term instability.

The Technology War in 2025

The tech war involves Semiconductors, AI, and Export Controls, as the U.S has reinforced the restrictions on selling advanced technology to China, which includes, especially,

- High-end semiconductors are used for AI and military tech.

- Quantum computing

- Green energy tech like EV batteries

How China Responds

- Investing heavily in AI research

- Finding loopholes in buying chips through a third party.

Where Are Companies Moving Production?

To avoid geopolitics and tariff risk, many other countries have diversified their business and supply chains to various countries like Vietnam, India, and Mexico.

| Below are the Top Alternative Manufacturing Hubs | ||

| Country | Industries Moving | Why? |

| Vietnam | Electronics, textiles, furniture | Low labor costs, stable trade with the U.S. |

| India | Smartphones, pharmaceuticals | Government incentives, growing tech workforce |

| Mexico | Automotive, aerospace | Proximity to the U.S., USMCA trade benefits |

| Thailand | Automotive parts, electronics | Strong infrastructure, less geopolitical risk |

Reaction to Global Trade:

- China’s supremacy is shrinking, but it still manages the world’s factory for many goods.

- Mexico is booming. As U.S. companies prefer shorter supply chains.

- Slower product launches occur because companies adjust to new factories.

How Are Consumers Affected?

Trade wars hit everyday shoppers in different ways. We can see the effect from the Price Changes in 2025

| Product | Price Trend (2025) | Why? |

| Smartphones | 5-10% higher | Chip shortages, tariffs on Chinese parts |

| Electric Vehicles | Slight drop | Lower tariffs on some models |

| Home Appliances | 3-8% higher | Steel tariffs increase production costs |

| Clothing & Shoes | Stable | Many brands shifted to Vietnam/Bangladesh |

What’s Next? Predictions for 2025 & Beyond

A. More Negotiations

- The U.S. and China are still talking, but neither of them wants to give down.

- Big tech still has restrictions, while Small compromises like agricultural

B. Splitting Tech Will Continue

- The geopolitical focus of the U.S. for allied countries like Japan and South Korea for chips

- It will take years to catch up, but China will invest in self-sufficiency.

C. Inflation & Economic Slowdown Risks

- Consumer prices could rise again if tariffs stay high.

- To ease trade barriers, a global recession might force both sides.

D. Green Energy & EVs: The New Battleground

- To dominate EV and battery production, there is a race in both nations

- New tariffs on Chinese EVs could come in late 2025.

Conclusion: How To Navigate Trade War

For Businesses:

- Modifier suppliers don’t rely only on China

- Stay updated on tariff changes

For Investors:

- Volatility may be expected on semiconductor and EV stocks.

- Examine companies from nearshoring, like Mexican manufacturing firms

For Consumers:

- Plan big and purchase wisely, as price fluctuations may occur.

- Support local businesses if possible.

| Home Page | https://aiis.org/ |

FAQ for Tariffs and Trade Wars

Are tariffs going away in 2025?

No, but some may be reduced to ease inflation.

Will the iPhone get more expensive?

Possibly yes, if chip export control screws up further.

Is China still the world’s factory?

Yes, but apart from China, Vietnam, India, and Mexico are growing faster.

Should I invest in Chinese stocks?

Modify interest in investing in China as there is a high risk due to geopolitical tensions.