From Infrastructure to Internet.In 2025, the government plans to invest from Infrastructure to Internet, the taxpayer funds in upgrading digital services, promoting and enhancing the economy. This will improve road facilities, internet access, cheaper taxes, and help for local technologies and manufacturers. The motive is to make the internet easier and affordable for everyone.

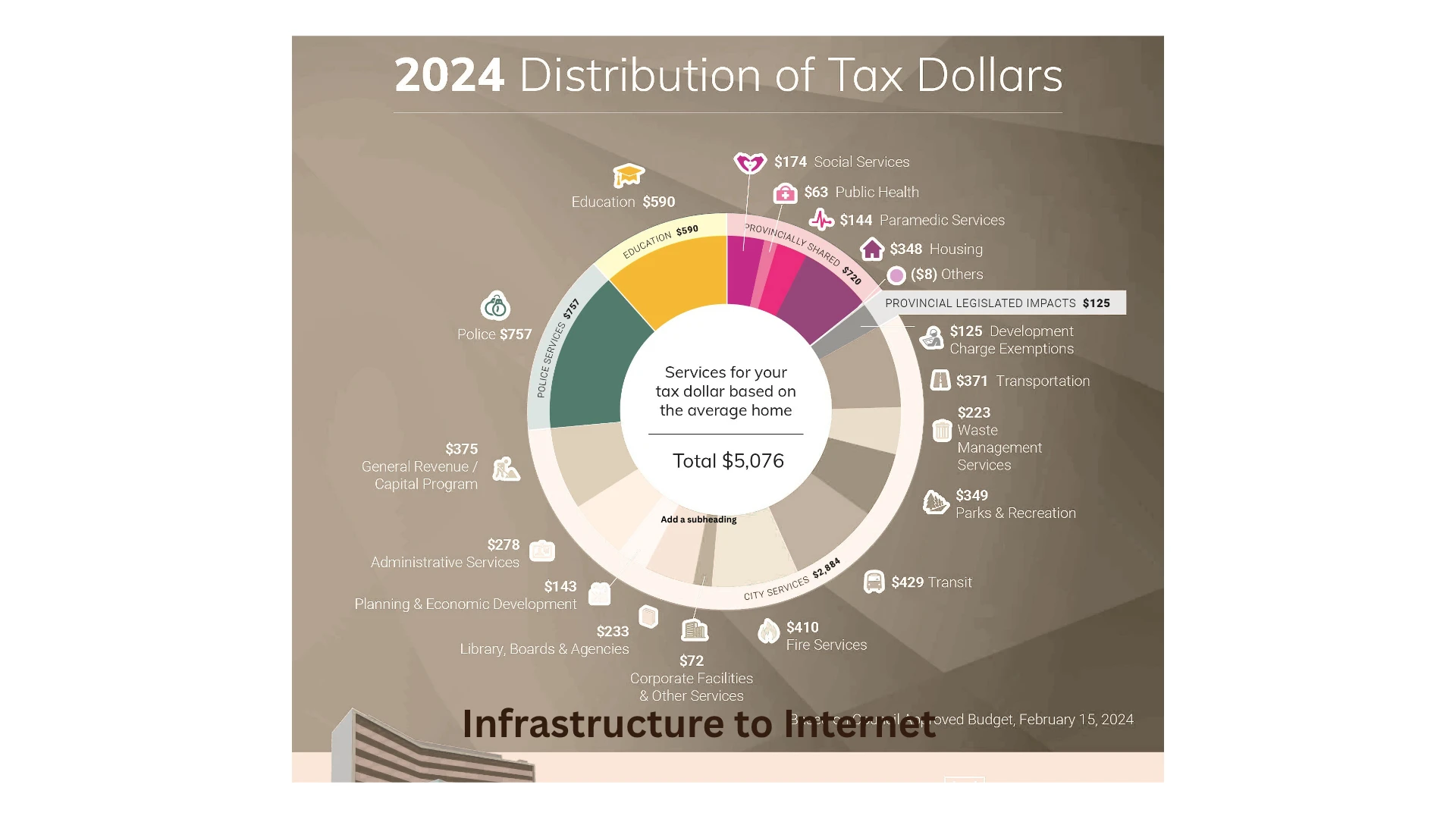

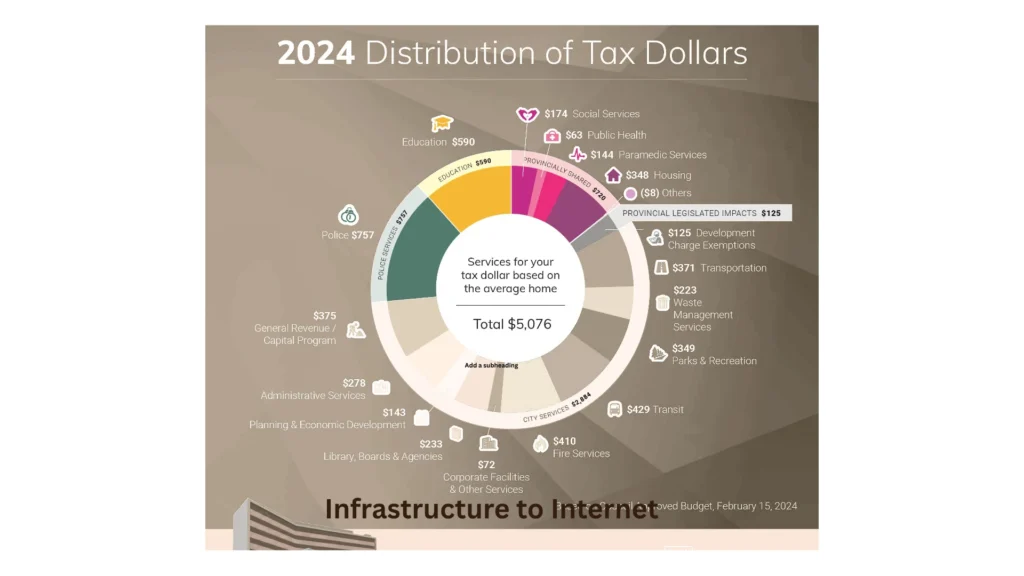

Paying taxes is like acquiring a colossus group and a gift for society, but somehow you never wondered where your money exactly ends in 2024. In 2024, governments are spending your tax dollars on everything from pothole repairs to AI-powered services, and we’re here to follow the money trail.

In this guide, you will learn about the spending breakdown in 2024, where your 2024 tax dollars are going, from infrastructure to digital upgrades. The key areas funded by taxes like highways, high-speed internet, and more. How to track government spending and what it means for you.

Infrastructure to Internet: Your Tax Dollars in 2024

The government pays taxes in many fields like social security, health care, defence, the army, various infrastructure, education, and internet technology. Below are some examples of what it covers for the tax paying area in 2025.

| Tax Paying Area In 2024 | ||

| Category | 2024 U.S. Spending | What It Covers |

| Social Security | $1.2 trillion | Retiree & disability payments |

| Healthcare (Medicare/Medicaid) | $1.7 trillion | Hospitals, insurance, and vaccines |

| Defense | $886 billion | Military, weapons, and veterans |

| Infrastructure | $550 billion | Roads, bridges, broadband |

| Education | $870 billion | Public schools, student loans |

| Tech & Internet | $150 billion | Cybersecurity, AI, rural WiFi |

| Interest on Debt | $1.0 trillion | Paying off loans (ouch!) |

Where are your 2024 tax dollars going?

In the U.S, most of the amalgamated tax dollars in 2024 gives funding in a few areas like Social Security, Medicare & Medicaid, which support old age people after retirement, healthcare for 60+ people or senior citizens, and below poverty line / low-income families.

Some funds are allocated in National Defense budgets, the biggest chunk covered by the military and security. Some funds are saved for Infrastructure & Education, while some are saved for Roads, bridges, broadband, and schools. So in many ways, like Social Services, Programs like food assistance and unemployment benefits.

1. Infrastructure Development: Building the Future

In 2025, Infrastructure Development is getting a major renovation. The government is funding various streams, like :

- Highways & Roads: For new expressways, highways and smoother, faster ways to communicate, and reduce the time zone and repair broken roads.

- Rail & Metro extension: In developing cities, the connectivity requires better infrastructure like rail and fast metro connectivity and extensions for communication.

- Smart Cities: urban areas are upgraded for better water supply, and precautions are taken to save water and energy systems in smart cities.

Why Does It Matter?

More job opportunities with Better infrastructure, which also helps in lower fewer traffic jams, faster deliveries, construction, and tech.

2. Social Security (24%)

- Supports old-age pensioners.

- Disabled workers and surviving family members.

- Funded by income or stipend taxes, it’s the largest single expense in the budget.

3. Medicare & Medicaid (20%)

- For seniors, Medicare health coverage is provided.

- For low-income families or for those below the poverty line, Medicaid covers all, including individuals.

4. National Defense (15%)

- Funds are distributed in military operations and defense technology.

- Which includes nuclear weapons, cybersecurity, and warehouse benefits.

5. Interest on National Debt (8%)

- Due to past deficits and growing debt, the Payments on the $34+ trillion owed to the U.S.

6. Infrastructure & Transportation (6%)

- Some percentage is invested in Roads, bridges, public transit, and broadband extension.

- Funds are included from the Bipartisan Infrastructure Law, developed in 2021.

7. Education (5%)

- Taxes are used in Public schools, scholarships, financial aid and student loans, and early childhood programs.

8. Veterans’ Benefits (4%)

- Needed for special children, Healthcare, disability pay, and housing support for veterans.

9. Food & Housing Assistance (3%)

- SNAP (food stamps), WIC, and Section 8 housing vouchers.

10 . Scientific & Medical Research (2%)

- The 2% tax is used for health research (NIH), NASA, and renewable energy projects.

11. Law Enforcement & Public Safety (2%)

- A collection of law enforcement, public safety, B I, federal courts, and border security, taxes are focused on disaster relief (FEMA)

Why This Matters to You:

- Every time taxe dollars come out of your paycheck, this is where that money goes. While military spending and debt payments keep increasing, schools and roads often have to fight for their share of funding. Conclusion:

Your Taxes at Work include various benefits.

Paying tax may feel like a burden, but from the above points, we can ensure that our money is going in the right direction, invested in a real and visible path. Benefits from infrastructure, cheaper internet, roads, to highways. The main goal is to strengthen the economy for better growth.

Ever wonder where the money from your paycheck deductions goes? Here’s the reality: more is being spent on defense and debt payments each year, leaving less available for improving schools, roads, and other vital services. The majority of tax is invested in social security, health, and defence. Almost 24%,21% and 13% of the total GDP.